TechDrop #01 | Qualcomm vs. Intel: The Next Big Tech Shakeup?

“The two most powerful warriors are patience and time” – Leo Tolstoy

1. Trendy Tech News

A. Will Qualcomm take over Intel?

A. Summary

Qualcomm made a bold move by approaching Intel for a possible takeover! This could shake up the tech world. A Qualcomm-Intel merger could shake up the semiconductor world by combining Qualcomm’s mobile and wireless tech with Intel’s dominance in PC and server processors.

With this merger, the new company would control a huge portion of the chip market, possibly leading to higher prices and slower innovation. If this deal goes through, it would be one of the biggest tech mergers ever! Intel’s worth over $90 billion—that’s huge!

This merger could trigger a wave of consolidations, with other companies like TSMC and Samsung racing to keep up. After the news broke, Intel’s stock jumped 3%, while Qualcomm’s dropped by the same amount. Talk about market drama!

Qualcomm could use Intel's designs to step up in AI processors and supercomputing, giving it an edge over competitors like Nvidia and AMD.

More funds in R&D could fast-track the next generation of chips, merging mobile and computing technologies even better. The deal might run into trouble with antitrust laws and national security concerns, especially since both Qualcomm and Intel have major business ties with China.

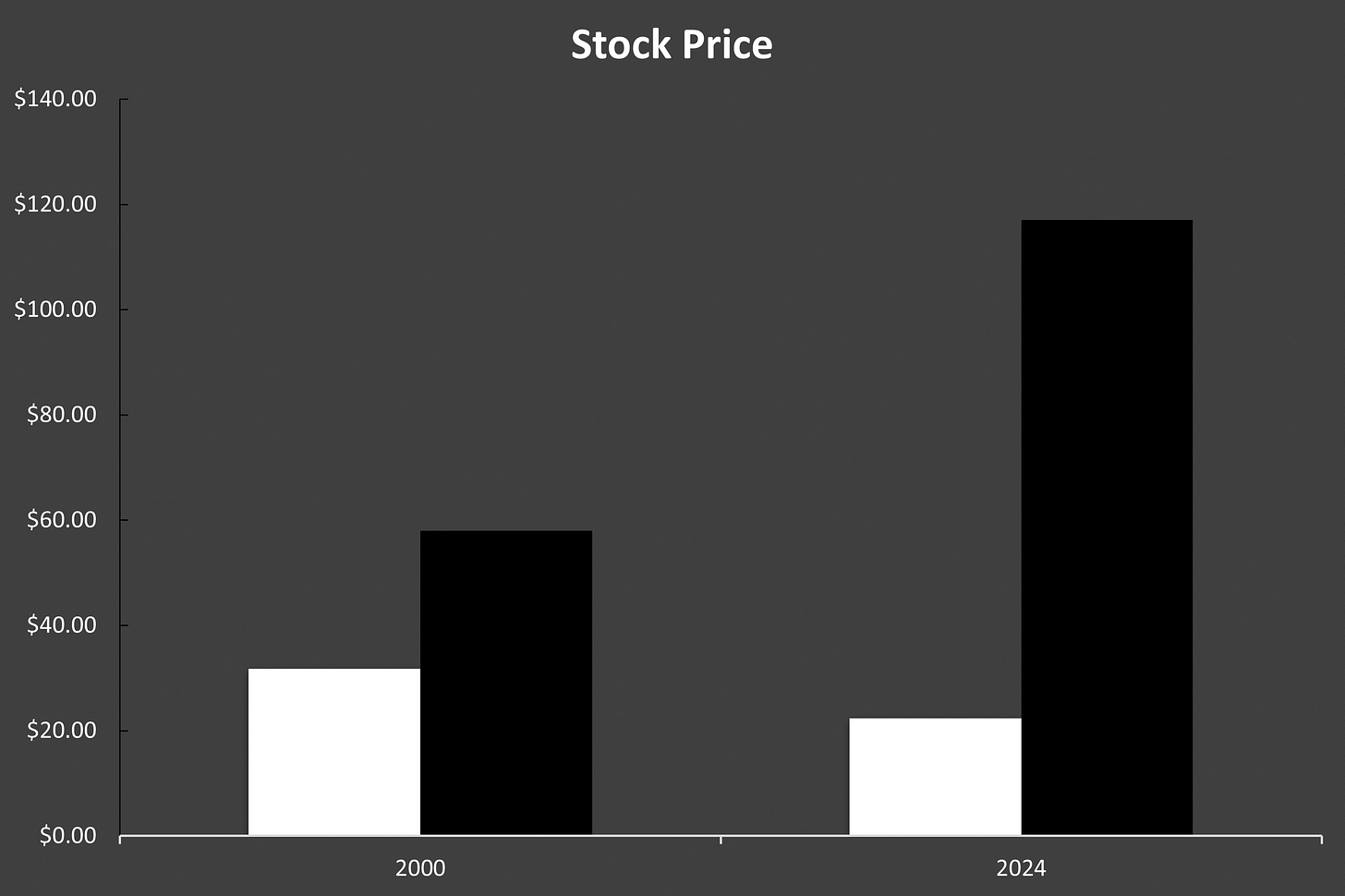

B. Market Share and Stock Price

Aspect Qualcomm Intel Stock Price Qualcomm’s stock is sitting at $168.32 as of October 2, 2024, showing strong investor confidence.

Intel’s stock is trading at about $22.39 as of October 2, 2024.

Stock Performance Qualcomm’s stock has ranged from $230.63 to $104.33 this year, driven by 5G tech and AI developments. Intel’s stock has fluctuated between $51.28 and $18.51 this past year—a wild ride for investors.

Market Capitalization Qualcomm’s market cap has climbed to $187.51 billion, way ahead of Intel’s recent struggles.

Intel's market cap is down to $96.96 billion, a big drop of nearly 40% from last year!

Historical Context Back in 2000, Qualcomm had a market cap of about $30 billion, showing significant growth over the past two decades. In 2000, Intel was worth a whopping $300 billion, showcasing its dominance in the chip game.

P/E Ratio Qualcomm's P/E ratio is approximately 21.5, suggesting it is relatively more attractively priced compared to Intel in terms of earnings potential. With a P/E ratio of 93.29, Intel's high ratio indicates investor concerns about its future growth.

Shares Outstanding The total number of shares outstanding for Qualcomm is about 1.11 billion, playing a critical role in its market cap. The total number of shares outstanding for Intel is about 4.27 billion, crucial for calculating its market cap.

C. Reference Links

Qualcomm recently approached Intel about a possible takeover (cnbc.com)

Chipmaker Qualcomm weighs friendly takeover of Intel - The Economic Times (indiatimes.com)

Qualcomm reportedly eyes Intel acquisition: What's on the table? | Capacity Media

2. Innovation Toolkit

A. GitHub:

GitHub is like the ultimate digital workspace for coding! It lets you control versions of your code and team up with other developers to build cool projects together. You can store, manage, and track all your code changes with GitHub. Whether you're coding solo or with a team, it keeps everything organized. Check out these awesome ways you can supercharge your productivity with GitHub:

3 worthy use cases

Collaboration on Projects:

Work together with friends or other coders by creating branches—these are separate paths where you can add your code without messing up the main project. Once you're ready, you can merge your changes back through pull requests, making teamwork smooth!

Automated Blog Post Publishing:

GitHub Actions lets you schedule blog posts like a pro! You can set it up so that your posts publish automatically, no need to lift a finger. Just configure a workflow to post your articles at the perfect time!

Continuous Integration/Continuous Deployment (CI/CD):

With GitHub’s CI/CD integration, you can automate testing and deployment of your code. This means that every time you make changes, the system tests and ships it fast—less waiting, more creating!

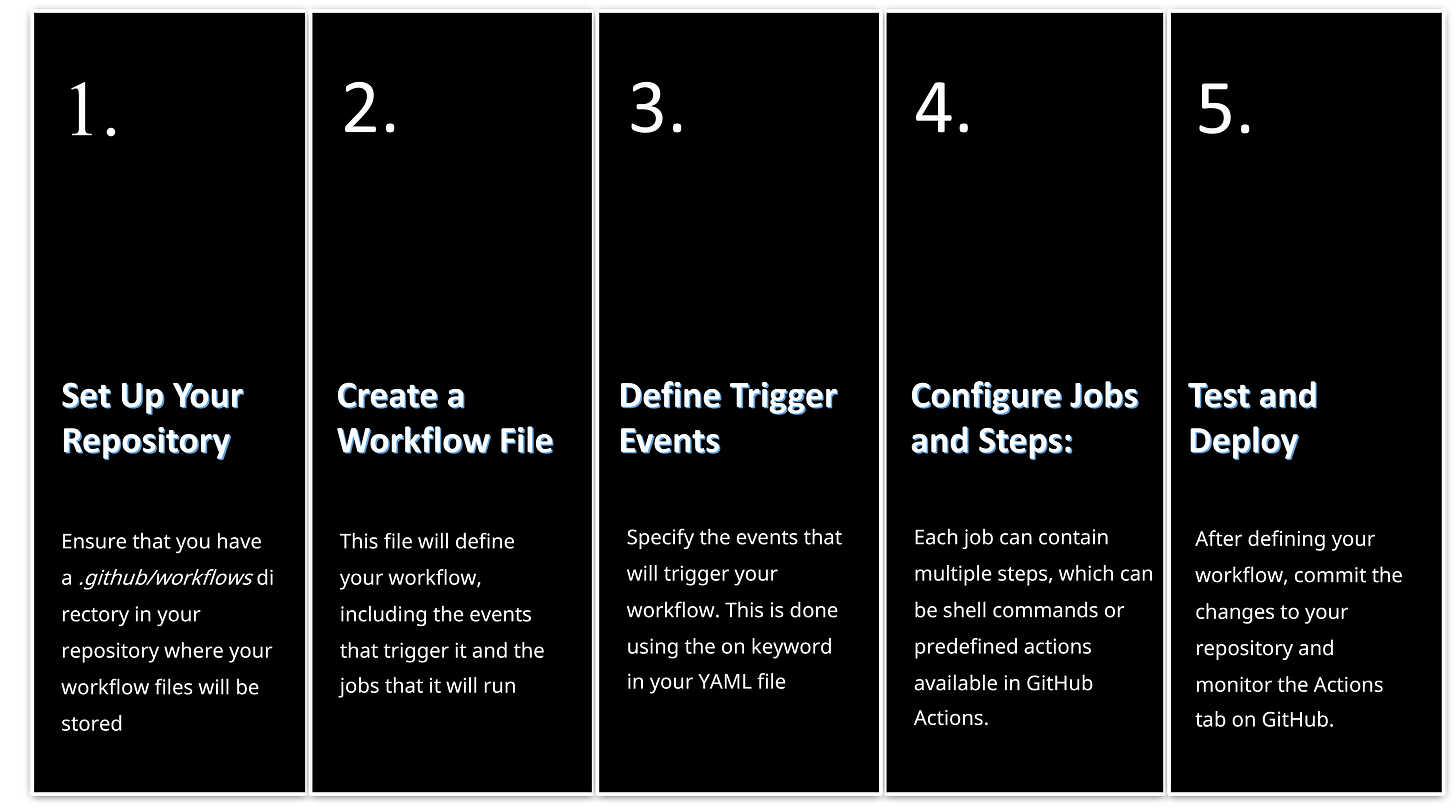

Steps for creating a workflow in GitHub

B. Notion:

Want to automate your posting game? Here are five genius ways to use Notion for scheduling and task automation:

Build an Automated Content Calendar

Use Notion to set up a super-organized content calendar. You can schedule blog posts, social media updates, or even newsletters. Add some automation magic—like triggering reminders or moving posts to a "Published" folder once they're marked as "Ready." Boom! No more forgetting to hit publish!

Automate Recurring Posts:

Set up Notion to create weekly or monthly tasks for you. It'll automatically generate pages for regular content like blog updates or reports, so you'll always stay on schedule. It’s like having a personal assistant for your content!.

Sync with Social Media Like a Boss:

Use tools like Zapier or Make.com to link Notion with your social media. You can automatically post updates to Twitter, LinkedIn, or any platform directly from your Notion database. One update in Notion, and it’s live everywhere!

Turn Meeting Notes into Action:

After a meeting, Notion can automatically create follow-up tasks based on your notes. It’s like turning your meeting notes into instant to-dos without extra work. Super efficient!

Email Reminders for Scheduled Posts:

Use Notion to fire off email notifications when posts are about to go live. Everyone on the team will get a heads-up, keeping them in the loop for the content launch!

With these Notion automation hacks, you'll cut down manual work and stay on top of every task like a pro.

3. Tech Box

A. Why is Shopping More Expensive on iPhones Compared to Android?

The price difference when shopping on iPhones vs. Android comes down to several factors:

App Development Costs

Developing for iOS is pricier due to strict guidelines and testing requirements. These costs often get passed on to users through higher app prices.

Willingness to Pay

iPhone users are more willing to spend on apps and in-app purchases. Developers know this and adjust pricing for the iOS market accordingly.

Apple’s Cut

Apple takes a 30% fee from in-app purchases (the infamous "Apple Tax"), which developers compensate for by increasing app and service prices.

Exclusive Ecosystem

Apple's closed ecosystem offers seamless integration but fewer alternatives. This lack of competition often leads to higher prices for certain services compared to Android.

Luxury Perception

iPhones are viewed as premium devices. Users often justify paying more for the perceived value, especially since iPhones hold their resale value better than many Android devices.

For Reference -